new york salt tax workaround

New Yorks pass-through entity tax PTET is one such SALT workaround. 16 2020 New York legislation was submitted to impose an unincorporated.

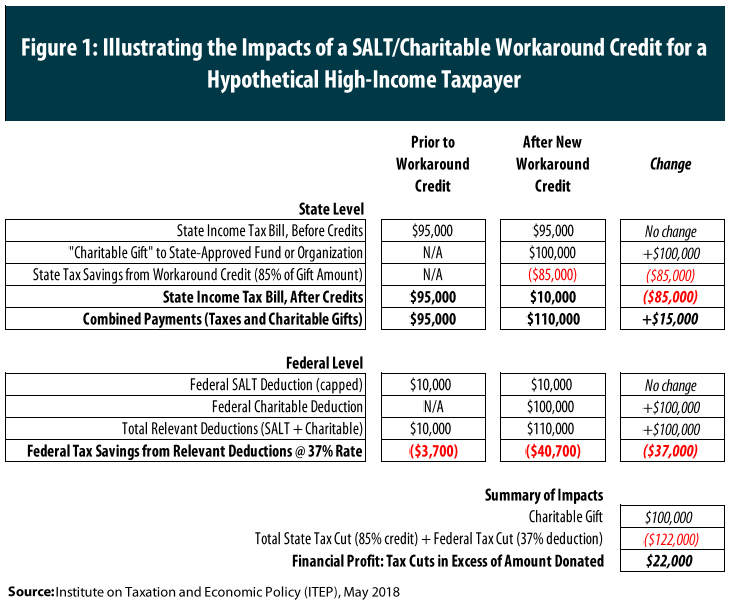

Salt Charitable Workaround Credits Require A Broad Fix Not A Narrow One Itep

The budget act includes a provision that allows partnerships and nys s corporations to elect to pay nys tax at the entity level in order to mitigate the impact of the 10000 cap on salt deductions.

_Table-1800px_v2a.jpg)

. July 1 2021 By WFFA. New York State 20212022 Budget Act SALT Cap Workaround The New York State NYS 20212022 Budget Act was signed into law on April 19 2021. Through new yorks other salt workaround known as the states employers compensation expense tax ecet employers that opt in will pay.

Enacted by the Tax Cuts and Jobs Act in 2017 the SALT cap has been a pain point for filers in high-tax states such as New York and New Jersey. And some lawmakers have been fighting to include a. The Budget Act includes a provision that allows partnerships and NYS S corporations to elect to pay NYS tax at the entity level in order to mitigate the impact of the 10000 cap on SALT deductions.

Over the weekend New York became the first state to create a state and local tax SALT deduction cap workaroundtwo workarounds in fact since New York does nothing on a small scale. New York State legislature included a SALT workaround in the most recently approved budget passed on April 6 2021. New York State Lawmakers Finally Agree to SALT Workaround.

South Carolina Again Extends Nexus Withholding Relief. The 2021-22 New York State budget legislation includes a Passthrough Entity PTE tax as a workaround for the 10000 state and local tax SALT cap which was enacted as part of the 2017 Tax Cuts and Jobs Act TCJA to limit the amount of state and local tax an individual could deduct on their federal income tax returns each year. Unlike most states New Yorks fiscal year begins early on April 1 so it was motivated to act quickly.

The limitation on the deductibility of state and local taxes SALT at 10000 was part of the Tax Cuts and Jobs Act back in 2017 and without pointing fingers it seemed to many like it may have been taking a. Through New Yorks other SALT workaround known as the states Employers Compensation Expense Tax ECET employers that opt in will pay a payroll tax on employees annual wages of 40000 or more and employees will receive a tax credit corresponding in value to the payroll tax paid. The New York State legislature and NYS Governor Cuomo reached an agreement for the fiscal year 20212022 state budget.

New York State enacted a work-around for the 10000 SALT deduction limitation in its budget bill signed into law in the spring of 2021 see our prior Alert here. The assembly and senate have passed the budget legislation and the legislation has been delivered to the governor for signature. The Pass-Through Entity tax allows an eligible entity to pay New York State tax.

New York City. On April 6 2021 New York Gov. April 15 2021 On April 7 2021 the New York State Legislature passed the 2021-22 budget bill which is expected to be signed by Governor Cuomo and enacted in its present form.

New York State Enacts Pass-Through Entity Tax as SALT Limitation Workaround. Friday December 18 2020. New York has issued long-awaited guidance and clarifications on the Pass-Through Entity Tax PTET via a Taxpayer Services.

The New York Department of Taxation and Finance issued guidance on the states adoption of a workaround to the federal cap on the state and local tax deduction for passthrough entities. SALT cap workaround enacted for 2023. On April 19 2021 New York Governor Andrew Cuomo signed into law legislation that creates a New York Pass-Through Entity Tax effective for tax years beginning on or after January 1 2021.

The legislation includes a Pass-Through Entity Tax that is intended to allow an individual member Member of a partnership other than a publicly traded partnership S corporation or. What seems clear are two things legislature. PdfDownload pdf14 MB Legislation enacted by New York State will allow a New York City City partnership or resident S corporation to elect to be subject to a new 3876 entity level tax.

It allows individuals with income from pass-through entities such as LPs LLCs and S Corps to mitigate the loss of their SALT deduction on the income earned through these entities by having these entities opt to pay a federally deductible PTET which is then creditable against their New York personal. Andrew Cuomo and the state legislature agreed to the fiscal year 2022 budget making a number of changes to the states tax code through Senate Bill 2509Assembly Bill 3009C including personal and corporate income tax rate increases an optional pass-through entity tax workaround and numerous other provisions. New York Passes SALT Workaround and Other Tax Changes WRITTEN ON APRIL 23 2021 As part of New York States 2021 2022 budget Governor Cuomo has approved some major changes to the tax law effecting both businesses and individuals.

While other states are considering workarounds to the Tax Cut and Jobs Acts TCJA 10000 annual limit on the federal deduction for state and local taxes SALT on individual income tax returns New York became the first state to pass actual legislation. New York Issues Guidance on SALT Cap Workaround. Proposed New York State Unincorporated Business Tax Provides SALT Limitation Workaround.

This consequential tax legislation available to electing pass-through entities provides a. Avoiding the SALT Limitation New York Enacts a Pass-Through Entity Tax to Help Taxpayers Work Around the SALT Limitation. A major part of the budget legislation is a new.

The tax is phased in over three years beginning January 1 2019. Yet while the newly adopted budget encourages high. New York State issues guidance on SALT cap workaround - Mazars - United States.

New Yorks SALT Avoidance Scheme Could Actually Raise Your Taxes.

Don T Miss The Election For The Salt Cap Workaround

The Other Salt Cap Workaround Accountants Steer Clients Toward Private K 12 Voucher Tax Credits Itep

New York City Salt Cap Workaround Enacted For 2023 Kpmg United States

Governor Signs Bill That Could Provide Pass Through Entities A Salt Deduction Cap Workaround

New York S Salt Workaround New Guidance Affected Industries And What To Know Before The October 15 2021 Deadline Insights Venable Llp

Pass Through Entity Salt Cap Workaround Lancaster Cpa Firm

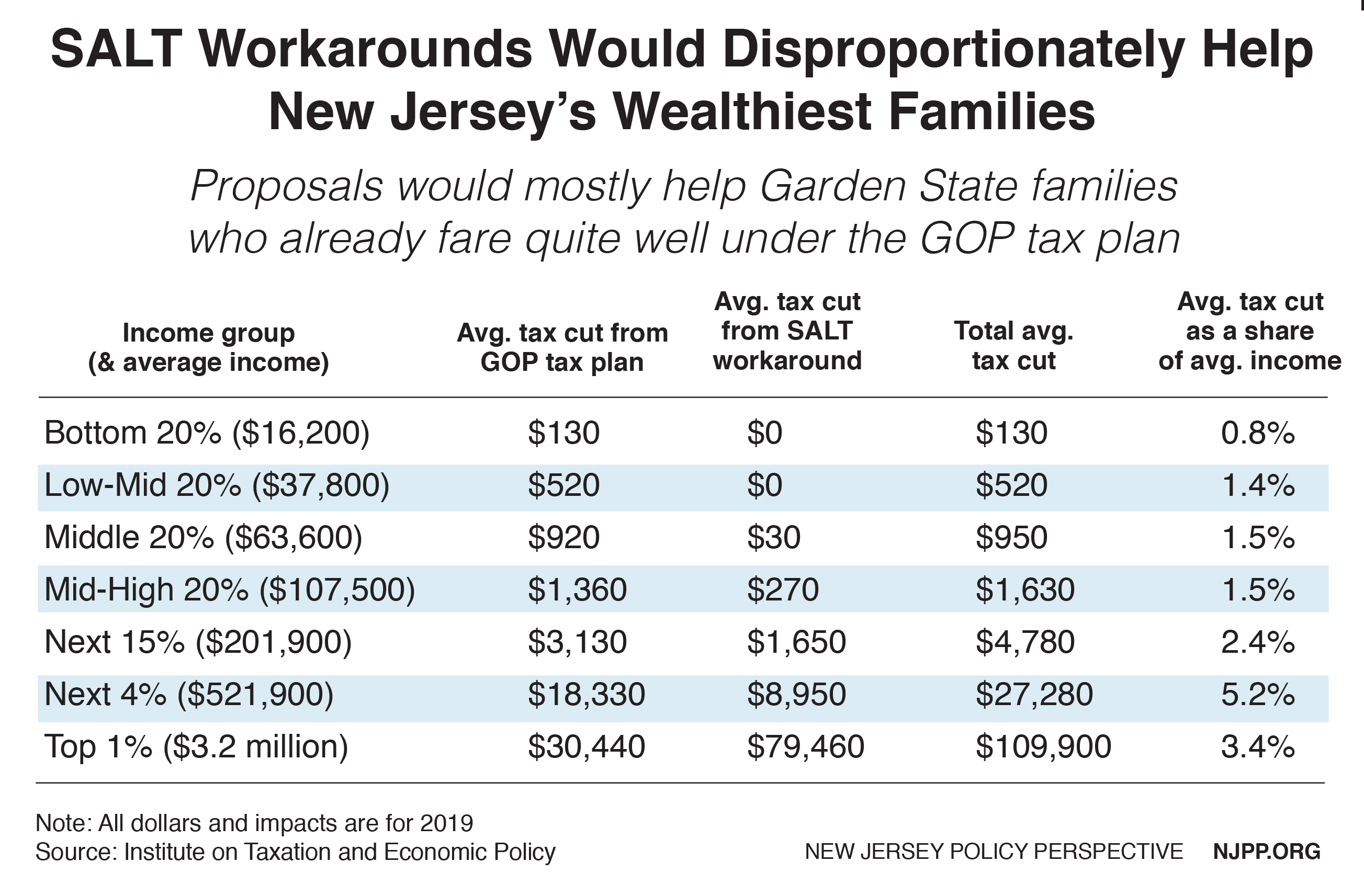

A Grain Of Salt New Jersey Needs More Than Workarounds To Respond To Gop Tax Plan New Jersey Policy Perspective

New York State Elective Pass Through Entity Tax Salt Cap Workaround Dannible And Mckee Llp

New York State Lawmakers Finally Agree To Salt Workaround Barclay Damon

S Corp Workaround For Salt Deduction Cap Wcre

Avoiding The Salt Limitation New York Enacts A Pass Through Entity Tax To Help Taxpayers Work Around The Salt Limitation Wffa Cpas

Salt Deduction Work Arounds Receive Irs Blessing Look For More States To Enact Them Marks Paneth

California Salt Cap Workaround Offered For Pass Through Entity Owners

Ny State Pass Through Entity Tax A S A L T Cap Workaround Fuoco Group

New York Enacts Pass Through Entity Tax Election As Salt Deduction Workaround Our Insights Plante Moran

Goldstein Often Overlooked Tax Savings Opportunity The Salt Cap Workaround Long Island Business News

Nj Passes Salt 10 000 Cap Work Around

Irs Issues New Regulations To Halt Ny State Workaround Of Federal Cap On Salt Deductions

_Table-1800px_v2a.jpg)

Can You Benefit From The Salt Cap Workaround J P Morgan Private Bank