child tax credit dates december 2020

The payments will be made either by direct deposit or by paper. Alphabetical Summary of Due Dates by Tax Type.

Parents Guide To The Child Tax Credit Nextadvisor With Time

For 2022 that amount reverted to 2000 per child dependent 16 and younger.

. Payment Dates for Weekly Payers. You were domiciled and maintained a primary residence as a homeowner or tenant in New Jersey during the tax year. If the monthly deposit rule applies deposit the tax for payments in December.

By making the Child Tax Credit fully refundable low- income households will be. 1400 in March 2021. The maximum amount of the child tax credit per qualifying child that can be refunded even if the taxpayer owes no tax.

Canada child benefit payment dates. Ad Complete IRS Tax Forms Online or Print Government Tax Documents. All payment dates.

3 January - England and Northern Ireland. However you do not have to make this payment if you file your 2019 return Form 1040 and pay any tax due by January 31 2020. 600 in December 2020January 2021.

Starting on July 15th through December families can get monthly Child Tax Credit payments of 250 per child between 6-17 or 300 per child under 6. 1200 in April 2020. In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of up to 3000.

January 1 2020 - December 31 2020. See what makes us different. The 2021 child tax credit payment dates along with the deadlines to opt out are as follows.

The maximum amount of the child tax credit per qualifying child. The maximum amount of the credit for. COVID-19 Stimulus Checks for Individuals.

The American Rescue Plan increased the amount of the Child Tax Credit from 2000 to 3600 for qualifying children under age 6 and 3000 for other qualifying children under age 18. 15 opt out by Aug. The credit amount was increased for 2021.

Chronological Listing of Filing Deadlines. October 5 2022 Havent received your payment. Your primary residence whether owned or rented was subject to property taxes that were paid either as actual property taxes or through rent.

The maximum child tax credit amount will decrease in 2022. 1400 in March 2021. For children under 6 the amount jumped to 3600.

Here are the official dates. The maximum child tax credit amount will decrease in 2022. The advance payments accounted for 50 of the credit you were due with the remainder and any adjustments to be claimed via your 2021 tax.

Lifestyle This is when Universal Credit child benefit and tax credits payment dates are over the Christmas period December 2020 Benefits. 150000 if you are married and filing a joint return or if you are filing as a qualifying widow or widower. 1200 in April 2020.

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. These payments were sent by direct deposit to a bank account or by mail as a paper check or a debit card. The maximum amount of the credit for.

Ontario trillium benefit OTB Includes Ontario energy and property tax credit OEPTC Northern Ontario energy credit NOEC and Ontario sales tax credit OSTC All payment. This would be 1800 for a child under 6 years old and 1500 for a child between 6 and 17. This is the final installment date for 2019 estimated tax.

Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics. Wait 10 working days from the payment date to contact us. The 2020 Child Tax Credit is intended to help offset the tremendous costs of raising a child or children.

You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than. We dont make judgments or prescribe specific policies. If you qualify the credit can be worth up to 2000 per child for Tax Years 2018-2025 in 2017 and earlier Tax Years the credit amount was 1000.

Ad Tax Strategies that move you closer to your financial goals and objectives. It is a partially refundable tax credit if you had earned income of at least 2500. The credit was made fully refundable.

Employers - Social Security Medicare and withheld income tax. We provide guidance at critical junctures in your personal and professional life. The CRA makes Canada child benefit CCB payments on the following dates.

You are eligible for a property tax deduction or a property tax credit only if. Claim the full Child Tax Credit on the 2021 tax return. The IRS issued three Economic Impact Payments during the coronavirus pandemic for people who were eligible.

However the deadline to apply for the child. Here are some numbers to know before claiming the child tax credit or the credit for other dependents. Have been a US.

28 December - England and Scotland only. CCB Payment Dates for 2022. We dont make judgments or prescribe specific policies.

How Those Child Tax Credit Checks May Affect Your Tax Refund This Year

First Month Without The Expanded Child Tax Credit Has Left Families In Distress Npr

Child Tax Credit 2022 How Next Year S Credit Could Be Different Kiplinger

Tax Tip Don T Forget Subsequent Required Minimum Distributions Are Due Tas

Absence Of Monthly Child Tax Credit Leads To 3 7 Million More Children In Poverty In January 2022 Columbia University Center On Poverty And Social Policy

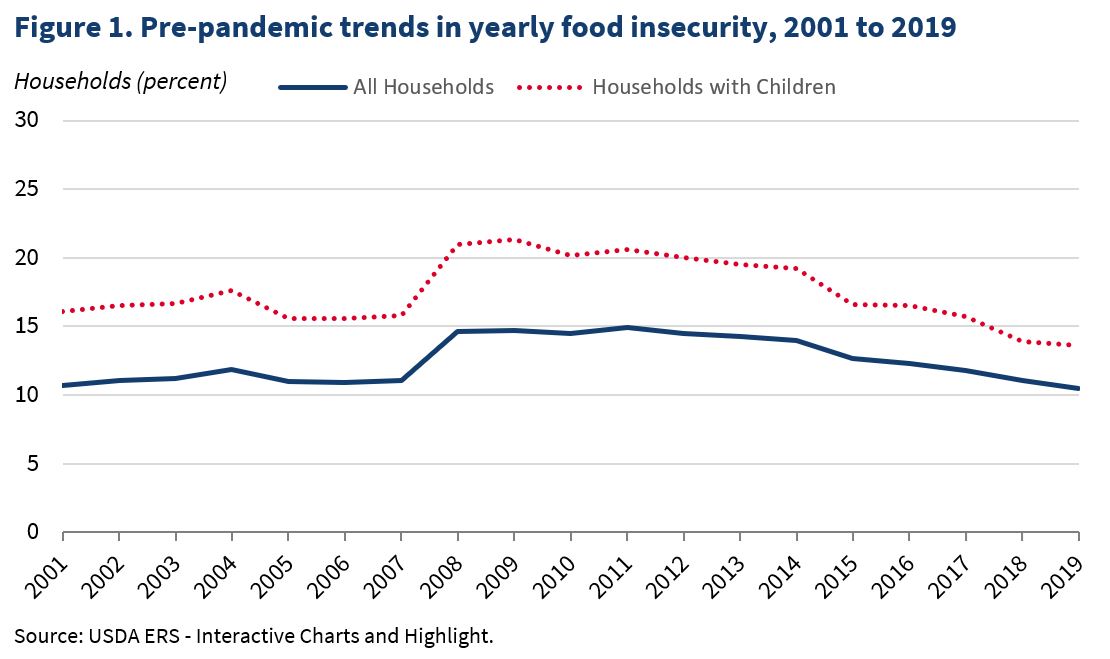

Gauging The Impact Of The Expanded Child Tax Credit S Expiration

Gauging The Impact Of The Expanded Child Tax Credit S Expiration

Employee Retention Tax Credit Office Of Economic And Workforce Development

Child Tax Credit Ending Will Push 10 Million Kids Back Into Poverty

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

Federal Income Support Helps Boost Food Security Rates The White House

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

Unemployment Benefits And Child Tax Credit H R Block

December S Payment Could Be The Final Child Tax Credit Check What To Know Cnet

2021 Child Tax Credit Advanced Payment Option Tas

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities